car sales tax wake county nc

Box 451 Smithfield NC 27577 Administration Mailing Address. North Carolina Department of Revenue.

2 Million Dollar Housesd Million Dollar Homes Multi Million Dollar Homes Dream House

Johnston street smithfield nc 27577 collections mailing address.

. What is the sales tax rate in Wake County. North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxes. See reviews photos directions phone numbers and more for Nc Sales Tax In Wake County locations in.

This is the total of state and county sales tax rates. Any municipal vehicle tax assessed in. Wake County Tax Portal.

Individual income tax refund inquiries. Apex Nc Apex Nature Park Opens December 2013 Near Bella Casa Del Norte Park Apex Nc To attach a lien to real estate the creditor can take or mail the Abstract of Judgment to the county recorders office in any California county where the debtor owns real estate now or may own it in the future. PO Box 25000 Raleigh NC 27640-0640.

A motor vehicle offered for sale by a dealer to the end. Plus 20 Recycling fee 196600 estimated annual tax. The term Motor Vehicle includes automobiles trucks buses campers trailers and motorcycles.

Children. Vehicles are also subject to property taxes which the NC. Property value divided by 100.

Values are based on the retail level of trade for property tax purposes. Please be certain to provide the mailing address to be used on your refund check. Historical County Sales and Use Tax Rates.

Assessments apply to each transaction. It is not intended to cover all provisions of the law or every taxpayers specific circumstances. Johnston Street Smithfield NC 27577 Collections Mailing Address.

In addition to taxes car purchases in North Carolina may be subject to other fees like registration title and plate fees. Box 368 Smithfield NC 27577. NCDMV FS-20 plate surrender form.

Although the process of assessing annual vehicle property taxes may seem somewhat complex the nc vehicle sales tax is relatively straightforward. The 725 sales tax rate in Cary consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax. Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Historical County Sales and Use Tax Rates.

The calculator should not be used to determine your actual tax bill. Collections by NCDMV employees are for taking acknowledgment of signatures on title and license application forms with a space for attestation before a notary public. Please enter the following information to view an estimated property tax.

See reviews photos directions phone numbers and more for Nc Sales Tax In Wake County locations in Cary NC. Dry Cleaners for Sale in Wake County NC. Sales and Use Tax Sales and Use Tax.

The Wake County sales tax rate is. Historical Total General State Local and Transit Sales and Use Tax Rates. Motor Vehicles are valued by year make and model in accordance with the North Carolina Vehicle Valuation Manual.

35 rows Wake. PO Box 25000 Raleigh NC 27640-0640. The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax.

This calculator is designed to estimate the county vehicle property tax for your vehicle. North Carolina car sales tax is easy to apply once you know the rules. 2000 x 9730 194600.

025 lower than the maximum sales tax in NC. Wake County offices will be closed Monday May 30 for Memorial Day. Wake County Tax Administration.

PO Box 25000 Raleigh NC 27640-0640. State offices are the NCDMV Headquarters 1110 New Bern Ave Raleigh and the West Charlotte Driver License Office 6016. North Carolina Department of Revenue.

Contact your county tax. Bill of Sale or a copy of the new state registration. North Carolina Department of Revenue.

Children. The minimum combined 2022 sales tax rate for Wake County North Carolina is. Your county vehicle property tax due may be higher or lower depending on other factors.

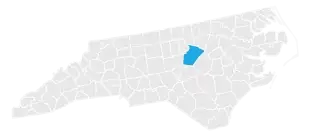

Wake County NC. Check our Holiday Schedule for more information. The total sales tax rate in any given location can be broken down into state county city and special district rates.

See reviews photos directions phone numbers and more for Nc Sales Tax In Wake County locations in North Raleigh Raleigh NC. The Wake County Sales Tax is collected by the merchant on all qualifying. Use the Wake County Tax Portal to view property details research comparable sales and to file a real estate appeal online.

The information included on this website is to be used only as a guide. For tax rates in other cities see North Carolina sales taxes by city and county. Historical Total General State Local and Transit Sales and Use Tax Rates.

This table shows the total sales tax. You can find these fees further down on the page. Johnston County Tax Administration Office.

County rate 60 Raleigh rate 3730 Combined Rate 9730 Recycling Fee 20. The 2018 United States Supreme Court decision in South Dakota v. A single-family home with a value of 200000.

You can print a 725 sales tax table here. Get more information on appealing vehicle personal and real property tax values. North Carolina Department of Military Veterans Affairs State Scholarship Program.

North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. Always check with your local DMV. Division of Motor Vehicles collects as defined by law on behalf of counties Revenue from the highway-use tax goes to the North Carolina.

The North Carolina state sales tax rate is currently. Wake Durham and Orange County Regional Transportation Authority Registration Tax. There is no applicable city tax.

The property is located in the City of Raleigh but not a Fire or Special District. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. North Carolina collects a 3 state sales tax rate on the purchase of all vehicles.

For vehicles that are being rented or leased see see taxation of leases and rentals.

Wake County Nc Property Tax Calculator Smartasset

New Hyundai Cars And Suvs For Sale Wake Forest Nc Raleigh

North Carolina Nc Car Sales Tax Everything You Need To Know

1 Killed 1 Charged In Crash That Closed Wake Forest Road For Several Hours Wral Com

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Phil Miller Avalaire Wake Forest House Dream House

Amazon Com Wake County North Carolina Zip Codes 48 X 36 Paper Wall Map Office Products

Wake County North Carolina Nc Jobs Wake Employment Opportunities Directory

North Carolina Sales And Use Tax Audit Guide

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Luxuryhomes My Dream Home Luxury Homes Dream Houses Dream Home Design

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

Used Cars Trucks And Suvs For Sale Wake Forest Nc Raleigh Durham

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

3312 Donlin Dr Wake Forest Nc 3 Baths Wake Forest Home Bedroom Flooring